In today's competitive business landscape, the role of skilled accountants extends far beyond mere number-crunching; they are pivotal in shaping a company's financial health and strategic direction.

Their expertise not only enhances the accuracy of financial reporting but also ensures compliance with regulatory standards, which can mitigate risks and foster stakeholder confidence.

Furthermore, adept accountants provide critical insights that can unveil opportunities for growth and operational efficiency. As we explore the multifaceted contributions of skilled accountants, it becomes evident that their impact can fundamentally alter the trajectory of a business in unforeseen ways.

Enhanced financial accuracy is a critical objective for organizations seeking to maintain robust financial health and compliance. Skilled accountants play a vital role in achieving this objective by meticulously managing financial records, ensuring that all transactions are accurately recorded and reported.

Their expertise in accounting principles and regulations minimizes the risk of errors, which can lead to costly financial discrepancies and compliance issues. Furthermore, proficient accountants utilize advanced software and analytical tools to streamline financial processes, enabling timely and precise reporting.

This enhanced accuracy not only builds trust with stakeholders but also facilitates informed decision-making, ultimately contributing to the organization's overall strategic goals. Investing in skilled accountants is, therefore, a prudent step towards achieving sustainable financial integrity and performance.

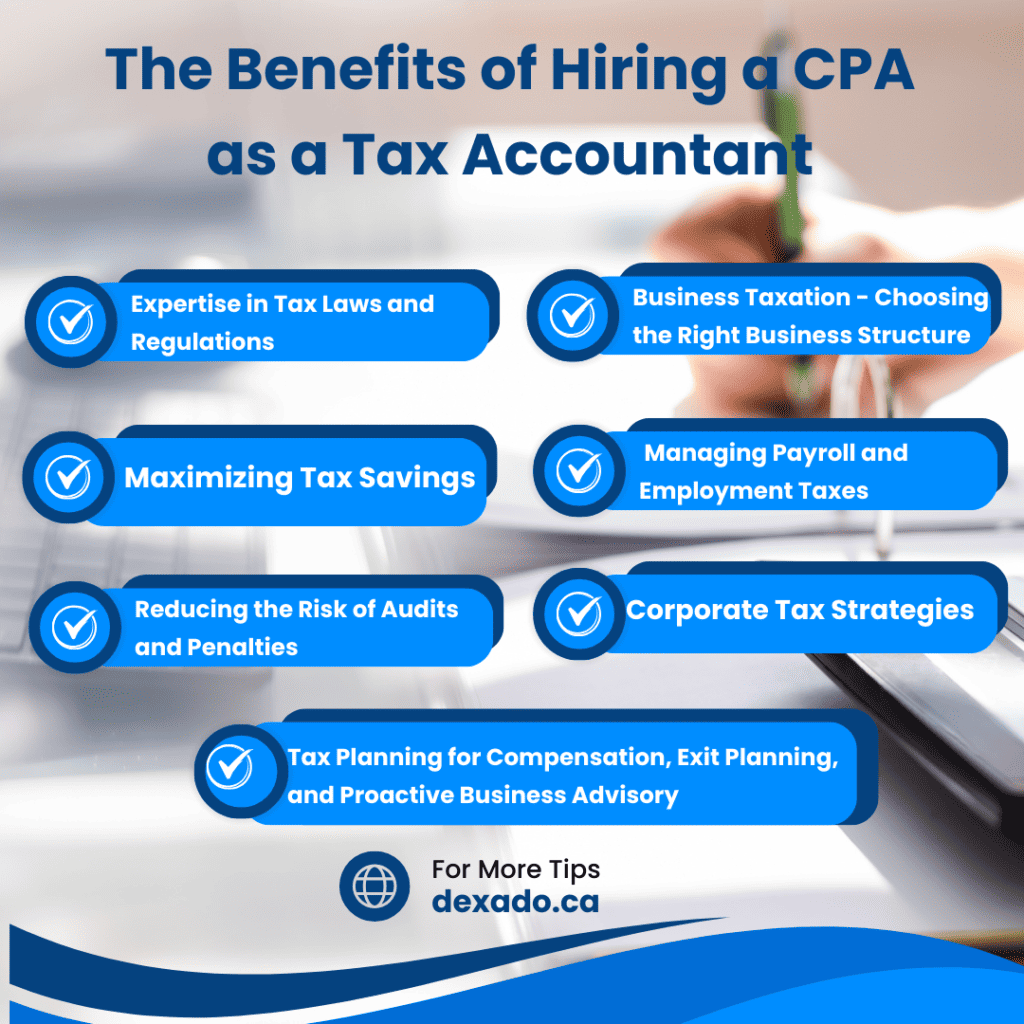

A robust tax management strategy is essential for businesses seeking to optimize their financial performance while ensuring compliance with regulatory requirements. Skilled accountants play a critical role in developing and implementing effective tax strategies that minimize liabilities and maximize deductions.

They stay abreast of the ever-evolving tax laws and regulations, enabling businesses to leverage available credits and incentives. By conducting thorough tax planning and analysis, accountants can identify potential risks and opportunities, guiding businesses toward informed decisions that align with their long-term financial goals.

Furthermore, effective tax management not only mitigates the risk of audits and penalties but also fosters a proactive approach to financial health. Ultimately, hiring skilled accountants is a strategic investment in a business's financial future.

Cash flow management is vital for the sustainability and growth of any business. Skilled accountants play a crucial role in optimizing cash flow by implementing effective budgeting and forecasting strategies. They analyze income and expenses to identify trends, allowing businesses to anticipate cash shortfalls and surpluses.

By maintaining accurate financial records, accountants provide timely insights into cash flow cycles, ensuring that funds are available for operational needs and strategic investments. Their expertise also aids in managing accounts receivable and payable efficiently, reducing delays in cash inflow and minimizing unnecessary expenditures.

Ultimately, hiring skilled accountants empowers businesses to maintain a healthy cash flow, enabling them to seize opportunities and navigate economic challenges with confidence. This proactive approach fosters long-term financial stability and growth.

Maintaining a robust cash flow is not only about managing income and expenses; it also involves navigating the complex landscape of compliance and risk management. Skilled accountants play a crucial role in ensuring your business adheres to financial regulations and standards, mitigating the risk of costly penalties.

Their expertise allows for the identification of potential compliance issues before they escalate, safeguarding your business's reputation and financial health. Moreover, these professionals implement systematic risk assessments, enabling proactive measures that protect assets and enhance decision-making.

By staying abreast of regulatory changes, skilled accountants ensure that your organization is not only compliant but also strategically positioned to thrive in a competitive market. Their contributions are invaluable for sustainable growth and operational resilience.

Understanding the dynamics of business growth is essential for any organization aiming to achieve long-term success. Skilled accountants play a pivotal role in this process by providing critical financial insights that inform strategic decision-making.

By analyzing financial trends and performance metrics, they help identify growth opportunities and potential risks, enabling businesses to navigate changing market conditions effectively. Furthermore, proficient accountants develop accurate forecasts that guide resource allocation and investment strategies, ensuring sustainable growth.

Their expertise in financial reporting not only enhances transparency but also builds trust with stakeholders, including investors and partners. Ultimately, hiring skilled accountants empowers organizations to make informed decisions that drive innovation and expansion, laying a solid foundation for future success.

Efficiency is paramount in today's fast-paced business environment, where time and resource optimization can significantly impact overall performance. Skilled accountants play a crucial role in this optimization process by streamlining financial operations, reducing redundancies, and ensuring compliance with regulatory standards.

Their expertise allows businesses to allocate resources more effectively, identify cost-saving opportunities, and enhance cash flow management. By automating routine tasks such as bookkeeping and reporting, accountants free up valuable time for business leaders to focus on strategic initiatives.

Moreover, their analytical capabilities empower organizations to make data-driven decisions, further improving operational efficiency. Ultimately, hiring skilled accountants not only transforms financial management but also positions businesses to thrive in a competitive landscape through enhanced productivity and resource utilization.

Various industries significantly benefit from hiring skilled accountants. Sectors such as healthcare, manufacturing, and retail often face complex regulatory requirements and financial reporting standards. Additionally, technology and professional services industries require precise financial oversight to manage rapid growth and innovation. Skilled accountants provide crucial expertise in tax compliance, financial strategy, and risk management, enabling businesses to make informed decisions and maintain operational efficiency. Ultimately, effective financial management is essential across all industries.

Determining if an accountant is suitable for your business involves assessing their qualifications, experience, and specialization. Evaluate their knowledge of your industry and familiarity with relevant regulations. Conduct interviews to gauge their communication skills and understanding of your financial objectives. Additionally, consider seeking references from previous clients to validate their performance. Finally, ensure their approach aligns with your company's culture and values, as this fosters a collaborative and effective working relationship.

There are several types of accountants available for hire, each specializing in different areas of financial management. These include certified public accountants (CPAs), who provide auditing and tax services; management accountants, who focus on internal financial analysis; forensic accountants, who investigate financial discrepancies; and tax accountants, who specialize in tax preparation and planning. Additionally, there are cost accountants, who analyze production costs, and financial analysts, who assess investment opportunities. Each type offers unique expertise tailored to specific business needs.